The e-brokerage system is the most sophisticated, fast and efficient financial broker management system on the market today.

Learn more...

EB Flex is a powerful yet easy to use online trading system available as a windows desktop application or through a browser.

Learn more...

The e-brokerage system is the most sophisticated, fast and efficient financial broker management system on the market today.

We can fulfill every need from simple administration to full clearing service for all derivitives across any exchanges.

Learn more...

e-brokerage offers its clients a complete global clearing solution across all listed derivatives markets.

The system offers comprehensive coverage as well as user-friendly solutions to our customers needs.

We provide maximum flexibility, rapid deployment and low cost ownership.

A clearing system is available as a service or as an in-house solution.

As a service model, we provide customers with a full administration service and staff training to enable them to handle day to day client requirements.

Our in-house solution system provides clients with the added benefit of being able to fully control data integration and is tailored to the clients individual needs.

Our state of the art operations systems provide a complete solution for both conventional and electronic delivery of customer information, on a single multi-currency statement, in a real-time manner.

It also provides a full range of services that enable clients to benefit in a cost efficient manner.

The services offered include a combination of software solution and administration services.

Additional external and internal systems can be integrated with minimal development effort.

Our unique and progressive infrastructure enables us to meet the varied needs of our clients with tailored clearing systems and trading platforms.

Our know how is based on years of experience and in depth knowledge of market needs.

Online trading is becoming a popular way to trade, not only for stocks, but also for futures. There are many trading platforms available today, but there are only a few which can provide a complete solution that will satisfy clients needs in competitive market environment.

We believe through our hard work and research we have accomplished a system which is user-friendly, flexible and above all can integrate to any vendor system with a minimum of fuss.

Our top technology only begins with EB system.

To request further information on our extensive clearing services or to simply discuss a solution to your clearing requirements please contact us.

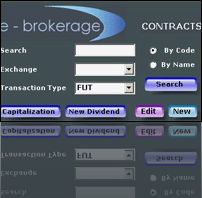

The e-brokerage back office system is the most intuitive, easy and quick to use system on the market today.

It can monitor accounts, contracts, commissions and trades with a single click.

Adding new data is also easy and intuitive.

The system can accommodate the most complex commission infrastructures and deliver regular reports on any aspect with minimal effort.

We believe, through our hard work and research, we have accomplished a system which is user-friendly, flexible and above all can integrate to any vendor system with a minimum of fuss.

Top technology begins with the EB system.

Take a tour of our back office system

The eb-flex online trading platform is a highly secure desktop application displaying all the information you need to make successful trading decisions with real-time execution.

- Multi-product platform — all products traded through the same application

- Wealth of market information, live prices, charts, market analysis and news

- Forex, including Spot Forex, trade orders

- OTC options and forward outrights

- Stocks

- Contracts for Difference (CFDs)

- All orders are confirmed when placed, executed or cancelled

- Use stop-loss orders to limit losses if the market moves against your position

- Futures

- 24-hour access to your accounts, instantly updated with your trades and their latest market value

e-brokerage offers its clients a complete Global Clearing solution across all listed derivatives markets. The system offers comprehensive coverage as well as user-friendly solutions to our customers needs. We provide maximum flexibility, rapid deployment and low cost ownership.

Our in house solution system provides clients with the added benefit of being able to fully control data integration and is tailored to the client’s individual needs.

Our state of the art operations systems provide a complete solution for both conventional and electronic delivery of customer information, on a single multi-currency statement, in a real-time manner. It also provides a full range of services that enable clients to benefit in a cost efficient manner. The services offered include a combination of software solution and administration services.

Additional external and internal systems can be integrated with minimal development effort.

Account Groups, primarily used for introducing brokers, salesmen and funds using same rate on commissions, interest, margins and close out methods.

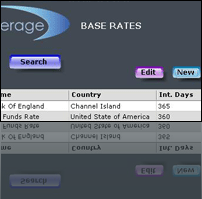

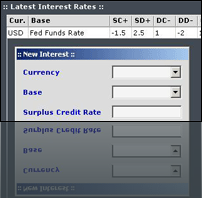

Base rates can be setup using global banks or country rates. This rate will be used in the system to generate interest payments or receiving interest.

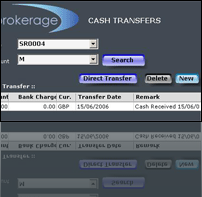

Create cash paid/received entries by party, account type and by currency.

There are 27 different categories selectable on the manual adjustment menu, these can be a trade or cash related adjustments.

On direct cash transfers you can move funds between accounts using a simple menu.

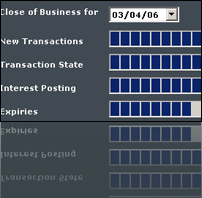

Once all trades and various inputs have been completed, the system can start running overnight batch processing. This will download all closing prices (required by the system) automatically and create statements and various other reports ready to send out to clients. We have created a fast and reliable overnight batch processing system.

Easily manage closeouts for large institutions by grouping them together.

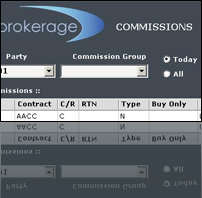

Commission groups is the easiest and fastest way to apply commission to individuals or group of clients sharing the same rate of commission.

Commission and return commission menus do play the most important factor of any system in a financial establishment therefore we have made remarkable research to accommodate the most sophisticated infrastructure levels of charge. The commission calculation can exceed over 10 different levels. Apply different charge rates as well as scaling for volume trading and minimum charges. also included are implemented day trading, spread, straddle, strangle and to finalise this it has full listed option commissions for exercise and assigned or abandoning.

Once an exchange has been set up, contracts and products may be added for the exchange and monitored with the extremely user friendly menus. Our specification also includes contract dates and prompts, margin requirements as well as a full calendar for expiry, deliveries, dividend and capitalisation for stocks and stock options.

Implement base currency rates to equity reports and conversion for different currencies.

All added rates are automatically inverted.

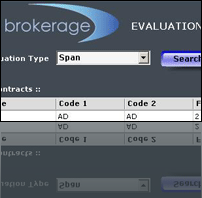

Covers all closing prices from various exchanges, especially CME and LIFFE Span data files.

Span data files are downloaded during the night and batch processed once the exchanges provide the settlement prices.

Live data may be easily obtained in any format for live account value updates and risk control.

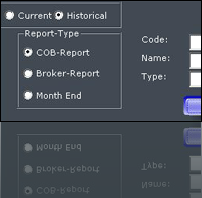

Provides a selection of reports in user friendly formats. Clients can use standard report templates or easily create their own report template designs. All enquiry reports may be created and delivered at any time and any interval as Excel files or a whole range of printable formats.

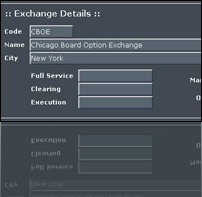

The system includes the most common exchanges around the world with scope to add any others.

Any collateral accepted to offset against the requirements of a chosen exchange, may be included.

Fees may also be set up for a chosen exchange which can be charged automatically if required.

Interest groups is an easy way of joining a group of clients who share the same rate of interest.

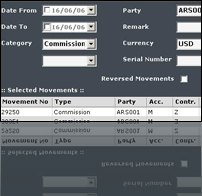

The movements menu is only used by administrators or managers for control purposes.

The definition of parties is anyone who opens or has an account set up in the system. There are two main functions on the party menu:

1) An easy wizard to help you setup new Clients, Branch, Divisions, Introducing Brokers, Salesmen, Operators, Banks and Headed accounts.

2) Providing complete information about parties i.e. account section for trading and cash balances, account details section for commission, close out and interest setups, cash transfer section for all cash paid or received. Account remarks can be used as a notepad and all communication between parties.

Once Close of Business has been executed, the system creates automatic equity reports for all parties and archives them. Historical reports may be obtained with minimal time, fuss and effort. For example, client historical reports may be retrieved in 5 minutes.

The system provides facility to produce reports in any language.

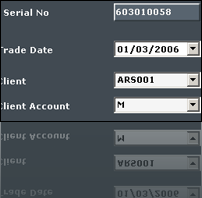

The Trade menu splits into two screens. The trade input screen is a quick and fast way of inputting single trade or bulk trades - Normal, FX, Equity Option, Stock and CFD's. The second screen confirms and validates the list of trades which have been input in the previous screen. Select a menu to exercise, assign or abandon options. The wait close-out option instructs the selected trade to remain open.

Once the trade has been input and has been validated, the system enables you to amend the trade or override the charges.